An older home with obsolete plumbing and also older wiring can enhance your premiums or make a house ineligible for insurance coverage - insurance premiums. While you can not alter the building day of your home, you can make updates that make the home much safer and also extra economical to insure. If you have an expansive, high-value home that is customized, it's mosting likely to set you back even more to guarantee it for its replacement price.

affordable homeowners insurance for home insurance insurance companies homeowner insurance cheaper insurance cheap

affordable homeowners insurance for home insurance insurance companies homeowner insurance cheaper insurance cheap

Discovering Economical Property Owners Insurance Coverage: Ways to Conserve While you can not regulate some aspects that influence your homeowners insurance policy price, such as your residence's place, its age, as well as its substitute cost, there are some things you can do to minimize your prices. a home owners insurance. These pointers can help you get the most affordable property owners insurance policy possible without sacrificing the high quality of your protection.

homeowners affordable low cost homeowners insurance insurance companies homeowners policy

homeowners affordable low cost homeowners insurance insurance companies homeowners policy

It's smart to only take into consideration plans that provide replacement-cost protection. 2. Obtain the Right Amount of Insurance coverage When you discover an insurance coverage carrier you trust, this part should be very easy. insurer. A great insurance coverage supplier will certainly aid you choose the appropriate amount of coverage for your home, your items, as well as your responsibility.

Depending upon where you live, you can obtain a 5 to 7. 5 percent price cut on your insurance coverage from Kin when you have proof of a centrally monitored security system (insurance premium). Kin provides clients a price cut when they have a system that automatically turns off the water supply when a leak is discovered.

, which is based on your debt rating, as an aspect to establish your premium. The reasoning is the better your rating, the much less most likely you are to make a claim (and also ultimately, you qualify for lower prices).

Our How Much Homeowners Insurance Do I Need? - Iii PDFs

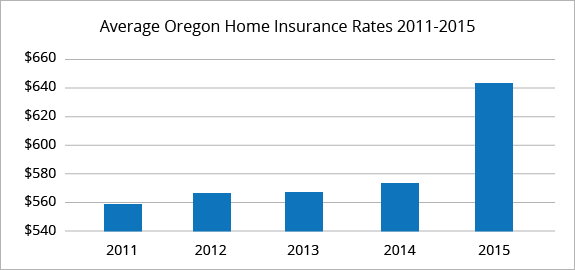

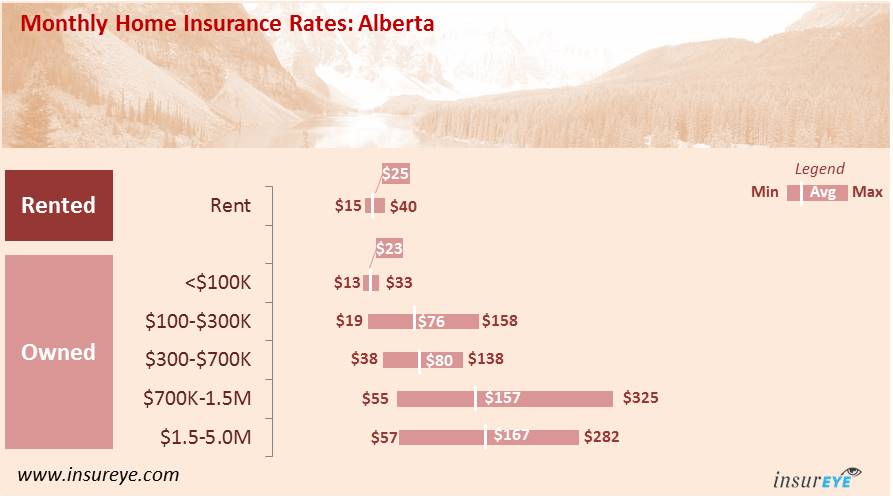

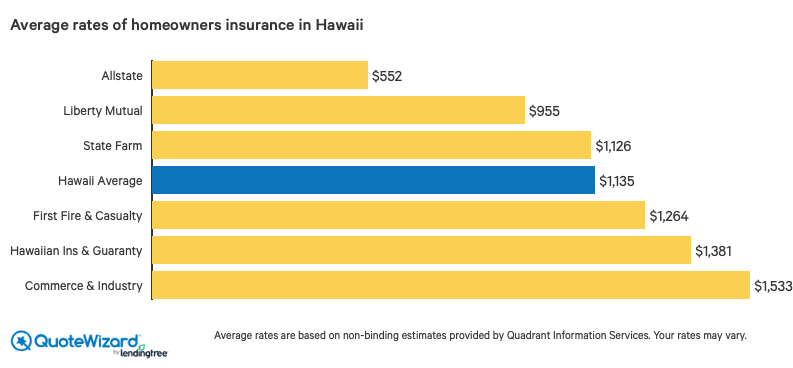

Average Home Insurance Policy Expense by Coverage Quantity The national average annual cost of home insurance policy in 2018 (the latest data available from the 2021 NAIC record) was $1,249, yet sorting the premiums by the house insurance coverage amount you choose can provide a more accurate prediction of what you might pay.

In the table listed below, we have actually provided a number of dwelling protection ranges and each array's average regular monthly costs: Average Residence Insurance Policy Cost by Location Insurance costs additionally vary based on your location. States at a greater risk for extreme climate, storms as well as twisters will usually have greater premiums due to the raised threat of residential or commercial property damage (a home insurance).

deductible deductibles affordable insurance property insurance a home insurance

deductible deductibles affordable insurance property insurance a home insurance

If you live in a location with high real-estate rates, you'll finish up paying more for house insurance policy since it will certainly set you back even more money to rebuild your residence. Residence insurance protection is separated into 6 groups (inexpensive).

Individual residential or commercial property insurance coverage (protection C) protects your individual possessions, both within and outside your home. If you endure a covered danger that damages or destroys your items, coverage C Click here for more info will pay to repair or replace your belongings.

You will certainly often have the choice to pay additional on your monthly premium for a higher level of security. Real cash value This is the cheapest level of defense and also one of the most inexpensive. With an actual money value policy, your insurance firm will pay you of what your belongings and/or home is worth, minus depreciation - property insurance.

Not known Incorrect Statements About Average Homeowners Insurance Rates By State 2022

Substitute price This medium degree of defense will bring a greater costs than a plan that pays actual cash money value since the depreciation isn't factored in. This will pay for the price to rebuild your home or change your ownerships without devaluation. Surefire substitute price This is the greatest level of defense as well as is usually much more costly than the other two policies. for home.

Numerous residence insurance policy companies likewise use extended limits in exchange for a higher costs, which enables property owners to get more protection. What Aspects Can Impact the Expense of Home Insurance?

Many property owners insurance intends enable you to pick your deductible. Usual deductibles are $500, $1,000, $2,500 or a tiny percent of your dwelling coverage. If you can afford a higher deductible, you can save money on your monthly premium - insurance companies. Insurers use your credit scores rating as well as credit rating to figure out the rate of your home insurance plan.

If you're regarding to purchase residence insurance or you currently have home insurance policy but intend to save money on your premiums, we recommend getting quotes from several carriers to compare costs. One very easy means to compare costs throughout providers is to call or complete with your ZIP Code and also some standard details regarding your house. for home.

If you combine your residence insurance with car insurance policy or one more insurance policy type, you can conserve cash on your plan. If your home was recently constructed, it's less vulnerable to damage than a home constructed in the 1920s. Discount rates for freshly created residences are one of the most generous of all discount rates for home owners insurance policy, so if your house is new, get in touch with your insurance policy carrier about a possible discount. homeowners policy.

Mark Lane: Windstorm Insurance Sticker Shock Hits Florida ... for Beginners

We reach out for example quotes, both over the phone and also on the web, to replicate an authentic customer experience. Right here are the elements that make up our company testimonials: Insurance coverage (20%): We evaluate each supplier's protection options, plan recommendations as well as coverage restrictions to figure out high quality of insurance coverage. Client service (15%): We additionally assess each firm's client service options such as online chat, a client support phone line and accessibility to agents - discount homeowners insurance.

lowest homeowners insurance homeowners insurance insurance property insurance for home insurance

lowest homeowners insurance homeowners insurance insurance property insurance for home insurance

Carriers that offer considerable discount rate choices, endorsements, customizable insurance coverage options and also unique functions rack up considerably greater than those that do not, putting them towards the top of our referrals to viewers. insurance cheap.

deductible homeowners insurance insurance premium insurance companies homeowners policy

deductible homeowners insurance insurance premium insurance companies homeowners policy

Determine How Much It Would Price to Restore Your House Having house owners insurance aids cover costs from damages because of points like fire, lightning, hail storm, cyclones to name a few occasions - insurance discount. As well as if you live in a location at high threat of flooding or earthquakes, you'll wish to make certain you have insurance coverage for those, as well.

A variety of factors will impact the expense to reconstruct: Points like the design of your house (e (cheap homeowners insurance). g. ranch, colonial), sort of products utilized to develop the structure (e. g. brick, rock, framework), sort of roof, as well as other unique functions of the house (e. g. fire places, exterior trim) can all impact the cost to rebuild your residence.

Attach with your insurance representative they'll help you determine exactly how much protection you'll need to rebuild your residence - credit.

Some Of How Much Does Homeowners Insurance Cost? - Experian

According to the National Association of Insurance Coverage Commissioners,. Depending on which state you live in, the ordinary price of home insurance can range from $781 to $3,383 per year.

Insurance and claims history The complying with are several of the factors that might be considered when identifying your property owners premium: Debt history Insurance coverage score Spaces in coverage Quantity of property owners declares Regularity of property owners declares High qualities of your new residence Age of the house Older designs might be more costly to guarantee since they usually aren't upgraded to neighborhood building codes.

Security and also safety and security functions Having the latest alarm system systems and also smoke detectors mounted can result in a reduced costs. Various other gadgets that can help in reducing payments include deadbolt locks, fire extinguishers, and also lawn sprinkler systems. The area of your home Among the most significant influences on your home owners insurance price is where you live.

Virginia The second greatest home insurance coverage costs remain in Virginia, with ordinary annual premiums of $1,181. Delaware "The First State" sign in at third for a lot of costly states to insure a residence in, with average annual rates of $1,172. 7 Budgeting for the month-to-month cost of home insurance coverage Insurance is created to conserve you money in the event of misfortune, yet it's still a monthly expenditure that needs to be developed into your spending plan.